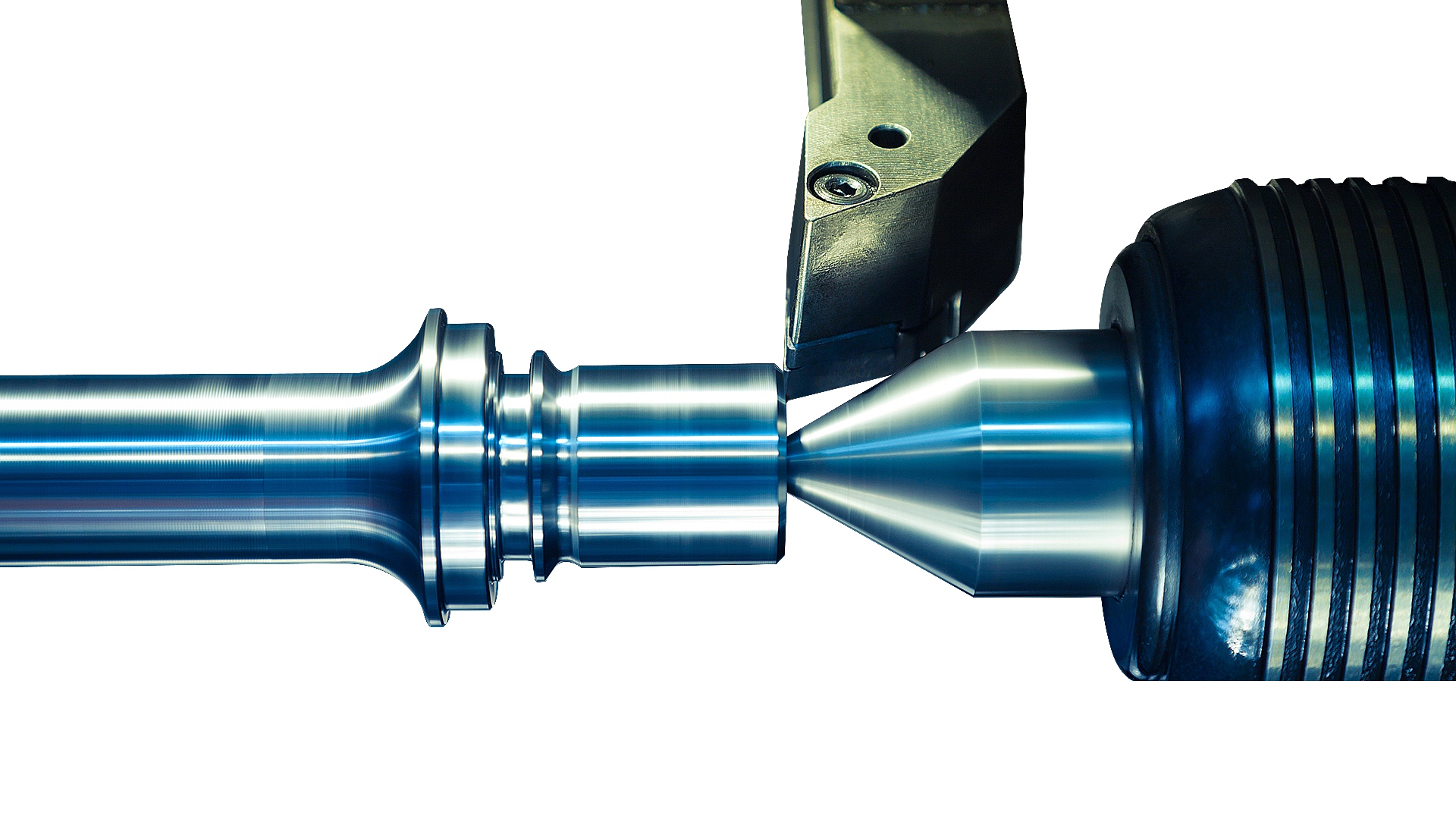

Operational improvements across portfolios or an individual approach to the overall management - what tactics are required to ensure efficient value creation in the companies in time of increased tensions?

The question of strategy for securing value creation in companies requires a differentiated approach. The most important factor for increasing the value of portfolio companies during the holding period is not financial but operational improvements. The range of possibilities has grown enormously in recent years. FTI-Andersch identifies levers for adapting technological innovations, streamlining and improving operating costs/processes or optimizing working capital. We always keep an eye on the success of the portfolio company and draw on many years of industry-wide experience. While in the consumer goods industry we focus on improved inventories and adapted receivables management, for companies in the automotive industry we primarily analyze production processes. These steps can free up cash for investment or debt reduction and help production to catch up with Industry 4.0 to gain a competitive advantage. Each portfolio company and each sector must be considered individually on a case-by-case basis in order to activate the appropriate levers.

Which levers can private equity funds use to establish more transparency in their portfolio companies?

Increasing transparency remains essential for a fund to measure the activities and successes in the portfolio. The introduction and regularity of meaningful reports is of the utmost importance for this. All managers in the company must be just as involved in this as those responsible at the PE companies. The development of the KPIs collected can only be analyzed and assessed in a dialogue. In terms of timing, these levers must be implemented at an early stage to guarantee the success of the investment. Effective reporting and meaningful overview cockpits based on digital platforms are required to successfully implement measures. We always work together with our digitalization team to achieve a measurable increase in transparency.

What shifts can the private equity market expect in the coming years? Are the causes already known today?

Our industry reports are often a point of contact for companies and funds to talk about the future. The market for private equity investors continues to grow. In 2023, growth has cooled down significantly compared to the successful past few years. Nevertheless, the sector is growing and is constantly pooling further financial resources. A volume of USD 5.8 trillion is expected by 2025 (2019: USD 4.5 trillion). Approaches such as the continuing trend towards internationalization are driving the market and opening up new avenues. This has two meanings:

Funds can no longer just increase the value of their portfolio in their home country through acquisitions and transactions, however, can also expand internationally.

And it is no longer just domestic capital providers that are competing for potential deals, but a much broader environment of international funds and institutions. The introduction of active monitoring processes also makes it possible to manage investments from abroad. Accordingly, there is no alternative to structured and transparent monitoring.