Seize digital opportunities

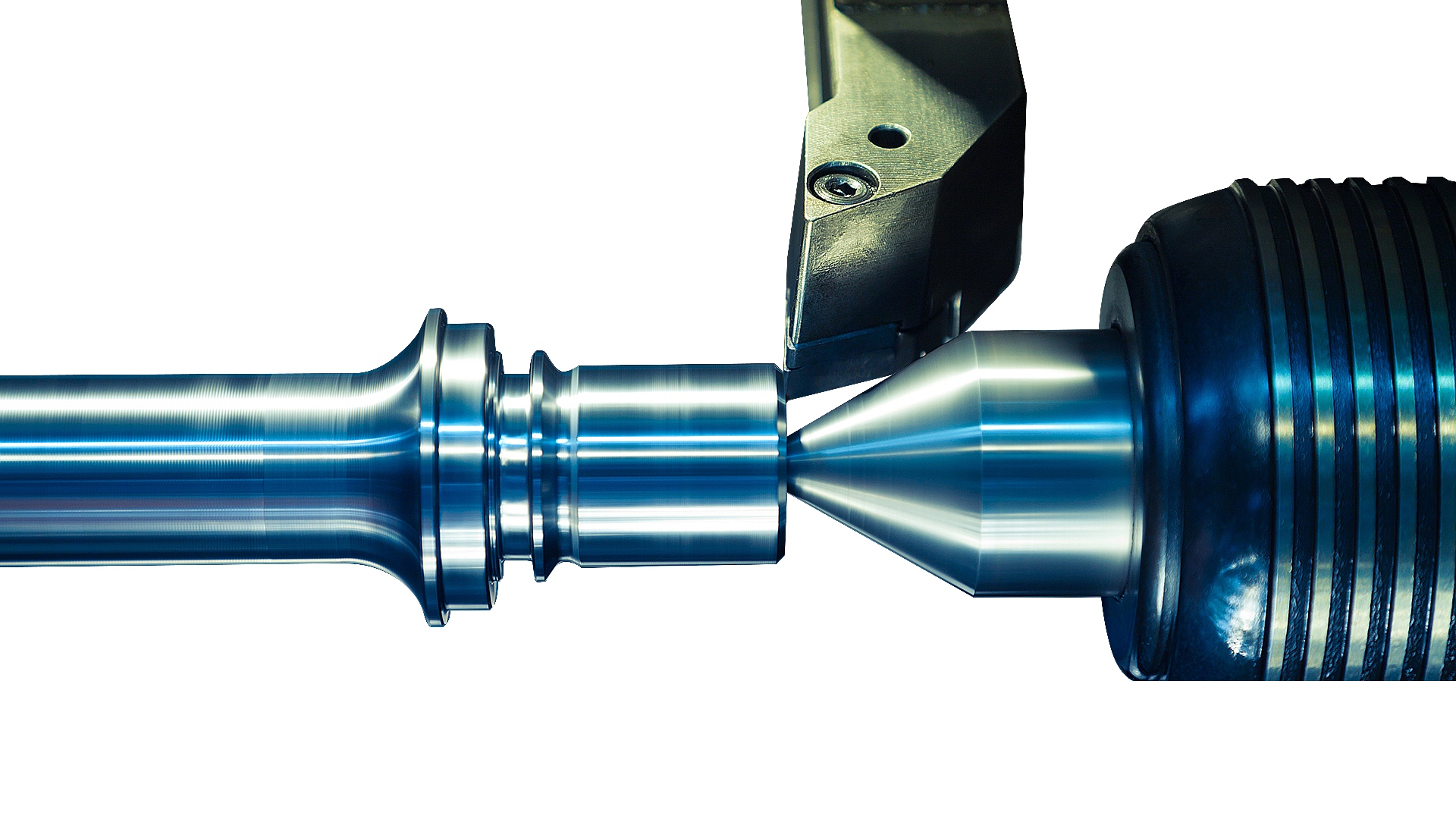

From brand positioning to sales channels and customer behavior – in the digitalized consumer goods market, nothing is as it used to be. Taking customer behavior as an example, even in traditional market segments such as furniture retailing, the online share are increasing rapidly. On the one hand, stationary sales are cannibalized; on the other hand, manufacturers are unlocking opportunities in direct sales. Customer expectations are shifting: as online platforms score in the fields of flexibility and availability, consumers are demanding the same from brick-and-mortar retailers. On the other hand, digitization is changing the production process of consumer goods. The ideal picture envisions seamlessly interlocking processes that anticipate every changing trend based on data, interlocked with "self-learning" production. In the end, only those who make intelligent use of their own data will be able to organize their operating business efficiently and develop products that meet the (new) demand.

The challenges are very diverse: On the one hand, you have to give your own brands recognition value, and on the other hand, you have to establish new digital sales channels and business models. We know the situation in the consumer goods market very well and create holistic strategies for our customers.

Stephan Lechel

Partner